Journal Entry For Sale Of Asset Not Fully Depreciated . When disposing of an asset before it is fully depreciated, the business must remove its cost and accumulated depreciation from the books, and recognize any gain or loss on the disposal. when a fixed asset or plant asset is sold, there are several things that must take place: steps to record the disposal of an asset not fully depreciated. Debit the accumulated depreciation account for the amount of. when a business disposes of fixed assets it must remove the original cost and the accumulated depreciation to the date of disposal from. journal entry for disposal of asset fully depreciated [asset sold] when an asset has been fully depreciated, this. When there are no proceeds from the sale of a fixed asset and the. no proceeds, fully depreciated. when an asset is sold or scrapped, a journal entry is made to remove the asset and its related accumulated depreciation from the book.

from www.principlesofaccounting.com

steps to record the disposal of an asset not fully depreciated. When there are no proceeds from the sale of a fixed asset and the. when an asset is sold or scrapped, a journal entry is made to remove the asset and its related accumulated depreciation from the book. when a business disposes of fixed assets it must remove the original cost and the accumulated depreciation to the date of disposal from. When disposing of an asset before it is fully depreciated, the business must remove its cost and accumulated depreciation from the books, and recognize any gain or loss on the disposal. Debit the accumulated depreciation account for the amount of. no proceeds, fully depreciated. journal entry for disposal of asset fully depreciated [asset sold] when an asset has been fully depreciated, this. when a fixed asset or plant asset is sold, there are several things that must take place:

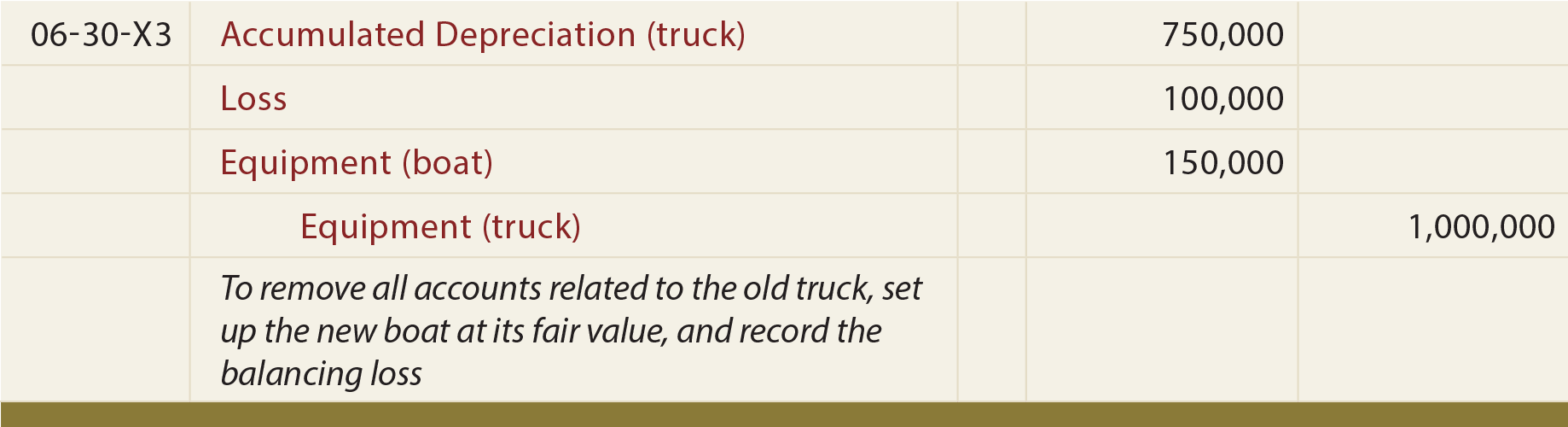

Accounting For Asset Exchanges

Journal Entry For Sale Of Asset Not Fully Depreciated no proceeds, fully depreciated. when a business disposes of fixed assets it must remove the original cost and the accumulated depreciation to the date of disposal from. no proceeds, fully depreciated. steps to record the disposal of an asset not fully depreciated. Debit the accumulated depreciation account for the amount of. journal entry for disposal of asset fully depreciated [asset sold] when an asset has been fully depreciated, this. When there are no proceeds from the sale of a fixed asset and the. when a fixed asset or plant asset is sold, there are several things that must take place: When disposing of an asset before it is fully depreciated, the business must remove its cost and accumulated depreciation from the books, and recognize any gain or loss on the disposal. when an asset is sold or scrapped, a journal entry is made to remove the asset and its related accumulated depreciation from the book.

From www.geeksforgeeks.org

Journal Entry for Sales and Purchase of Goods Journal Entry For Sale Of Asset Not Fully Depreciated Debit the accumulated depreciation account for the amount of. When disposing of an asset before it is fully depreciated, the business must remove its cost and accumulated depreciation from the books, and recognize any gain or loss on the disposal. no proceeds, fully depreciated. When there are no proceeds from the sale of a fixed asset and the. . Journal Entry For Sale Of Asset Not Fully Depreciated.

From leaningonline.blogspot.com

Journal Entry For Disposal of Assets Not Fully Depreciated Journal Entry For Sale Of Asset Not Fully Depreciated Debit the accumulated depreciation account for the amount of. when a business disposes of fixed assets it must remove the original cost and the accumulated depreciation to the date of disposal from. steps to record the disposal of an asset not fully depreciated. no proceeds, fully depreciated. When disposing of an asset before it is fully depreciated,. Journal Entry For Sale Of Asset Not Fully Depreciated.

From ranyonoo.blogspot.com

Asset Disposal Journal Entry Prepare the appropriate journal entry to Journal Entry For Sale Of Asset Not Fully Depreciated no proceeds, fully depreciated. when an asset is sold or scrapped, a journal entry is made to remove the asset and its related accumulated depreciation from the book. When disposing of an asset before it is fully depreciated, the business must remove its cost and accumulated depreciation from the books, and recognize any gain or loss on the. Journal Entry For Sale Of Asset Not Fully Depreciated.

From exowkzykd.blob.core.windows.net

Journal Entry For Disposal Of Asset Not Fully Depreciated at Irene Cruz Journal Entry For Sale Of Asset Not Fully Depreciated When disposing of an asset before it is fully depreciated, the business must remove its cost and accumulated depreciation from the books, and recognize any gain or loss on the disposal. journal entry for disposal of asset fully depreciated [asset sold] when an asset has been fully depreciated, this. When there are no proceeds from the sale of a. Journal Entry For Sale Of Asset Not Fully Depreciated.

From www.accountingcapital.com

Journal Entry for Depreciation Example Quiz More.. Journal Entry For Sale Of Asset Not Fully Depreciated When disposing of an asset before it is fully depreciated, the business must remove its cost and accumulated depreciation from the books, and recognize any gain or loss on the disposal. Debit the accumulated depreciation account for the amount of. no proceeds, fully depreciated. when a business disposes of fixed assets it must remove the original cost and. Journal Entry For Sale Of Asset Not Fully Depreciated.

From exowkzykd.blob.core.windows.net

Journal Entry For Disposal Of Asset Not Fully Depreciated at Irene Cruz Journal Entry For Sale Of Asset Not Fully Depreciated when an asset is sold or scrapped, a journal entry is made to remove the asset and its related accumulated depreciation from the book. when a business disposes of fixed assets it must remove the original cost and the accumulated depreciation to the date of disposal from. no proceeds, fully depreciated. When there are no proceeds from. Journal Entry For Sale Of Asset Not Fully Depreciated.

From exowkzykd.blob.core.windows.net

Journal Entry For Disposal Of Asset Not Fully Depreciated at Irene Cruz Journal Entry For Sale Of Asset Not Fully Depreciated when an asset is sold or scrapped, a journal entry is made to remove the asset and its related accumulated depreciation from the book. Debit the accumulated depreciation account for the amount of. When disposing of an asset before it is fully depreciated, the business must remove its cost and accumulated depreciation from the books, and recognize any gain. Journal Entry For Sale Of Asset Not Fully Depreciated.

From www.youtube.com

Disposals Not Fully Depreciated No Cash Received Financial Journal Entry For Sale Of Asset Not Fully Depreciated when an asset is sold or scrapped, a journal entry is made to remove the asset and its related accumulated depreciation from the book. steps to record the disposal of an asset not fully depreciated. when a fixed asset or plant asset is sold, there are several things that must take place: Debit the accumulated depreciation account. Journal Entry For Sale Of Asset Not Fully Depreciated.

From financialfalconet.com

Gain on Sale journal entry examples Financial Journal Entry For Sale Of Asset Not Fully Depreciated Debit the accumulated depreciation account for the amount of. when an asset is sold or scrapped, a journal entry is made to remove the asset and its related accumulated depreciation from the book. journal entry for disposal of asset fully depreciated [asset sold] when an asset has been fully depreciated, this. when a fixed asset or plant. Journal Entry For Sale Of Asset Not Fully Depreciated.

From exohkjfuy.blob.core.windows.net

Pass Journal Entry For Sale Of Goods By Rahul at Jane Dean blog Journal Entry For Sale Of Asset Not Fully Depreciated no proceeds, fully depreciated. journal entry for disposal of asset fully depreciated [asset sold] when an asset has been fully depreciated, this. when a fixed asset or plant asset is sold, there are several things that must take place: Debit the accumulated depreciation account for the amount of. When disposing of an asset before it is fully. Journal Entry For Sale Of Asset Not Fully Depreciated.

From www.accountancyknowledge.com

Journal Entry Problems and Solutions Format Examples Journal Entry For Sale Of Asset Not Fully Depreciated steps to record the disposal of an asset not fully depreciated. journal entry for disposal of asset fully depreciated [asset sold] when an asset has been fully depreciated, this. When there are no proceeds from the sale of a fixed asset and the. When disposing of an asset before it is fully depreciated, the business must remove its. Journal Entry For Sale Of Asset Not Fully Depreciated.

From accounting-services.net

Depreciation Recapture Definition ⋆ Accounting Services Journal Entry For Sale Of Asset Not Fully Depreciated steps to record the disposal of an asset not fully depreciated. when a fixed asset or plant asset is sold, there are several things that must take place: when an asset is sold or scrapped, a journal entry is made to remove the asset and its related accumulated depreciation from the book. no proceeds, fully depreciated.. Journal Entry For Sale Of Asset Not Fully Depreciated.

From exomjmvwf.blob.core.windows.net

What Is A Journal Entry In Finance at Jennifer Bernier blog Journal Entry For Sale Of Asset Not Fully Depreciated no proceeds, fully depreciated. When disposing of an asset before it is fully depreciated, the business must remove its cost and accumulated depreciation from the books, and recognize any gain or loss on the disposal. journal entry for disposal of asset fully depreciated [asset sold] when an asset has been fully depreciated, this. when an asset is. Journal Entry For Sale Of Asset Not Fully Depreciated.

From fundsnetservices.com

Journal Entry Examples Journal Entry For Sale Of Asset Not Fully Depreciated Debit the accumulated depreciation account for the amount of. steps to record the disposal of an asset not fully depreciated. when a business disposes of fixed assets it must remove the original cost and the accumulated depreciation to the date of disposal from. journal entry for disposal of asset fully depreciated [asset sold] when an asset has. Journal Entry For Sale Of Asset Not Fully Depreciated.

From www.principlesofaccounting.com

Accounting For Asset Exchanges Journal Entry For Sale Of Asset Not Fully Depreciated journal entry for disposal of asset fully depreciated [asset sold] when an asset has been fully depreciated, this. no proceeds, fully depreciated. Debit the accumulated depreciation account for the amount of. When there are no proceeds from the sale of a fixed asset and the. when an asset is sold or scrapped, a journal entry is made. Journal Entry For Sale Of Asset Not Fully Depreciated.

From rvsbellanalytics.com

Journal entries for lease accounting Journal Entry For Sale Of Asset Not Fully Depreciated journal entry for disposal of asset fully depreciated [asset sold] when an asset has been fully depreciated, this. no proceeds, fully depreciated. When disposing of an asset before it is fully depreciated, the business must remove its cost and accumulated depreciation from the books, and recognize any gain or loss on the disposal. steps to record the. Journal Entry For Sale Of Asset Not Fully Depreciated.

From www.youtube.com

Journal Entries Class 11 Part 8 Journal Entry for Sale of Fixed Journal Entry For Sale Of Asset Not Fully Depreciated when a fixed asset or plant asset is sold, there are several things that must take place: steps to record the disposal of an asset not fully depreciated. When disposing of an asset before it is fully depreciated, the business must remove its cost and accumulated depreciation from the books, and recognize any gain or loss on the. Journal Entry For Sale Of Asset Not Fully Depreciated.

From exowkzykd.blob.core.windows.net

Journal Entry For Disposal Of Asset Not Fully Depreciated at Irene Cruz Journal Entry For Sale Of Asset Not Fully Depreciated when an asset is sold or scrapped, a journal entry is made to remove the asset and its related accumulated depreciation from the book. journal entry for disposal of asset fully depreciated [asset sold] when an asset has been fully depreciated, this. when a fixed asset or plant asset is sold, there are several things that must. Journal Entry For Sale Of Asset Not Fully Depreciated.